Car title loans Greenville TX offer quick cash but require strategic management. Create a budget post-loan approval to balance short-term needs and long-term goals. Prioritize repaying the loan, cut non-essentials, and consider debt consolidation for stability.

After securing a car title loan in Greenville, TX, creating a budget becomes your financial compass. This guide is designed to help you navigate the journey of loan repayment with confidence. We’ll first demystify car title loans in Greenville, TX, clarifying how they work and their implications. Then, we’ll outline practical steps for budgeting post-loan approval, followed by effective spending strategies tailored to repaying your loan responsibly.

- Understanding Car Title Loans Greenville TX

- Steps to Budget After Securing a Loan

- Effective Spending Strategies for Loan Repayment

Understanding Car Title Loans Greenville TX

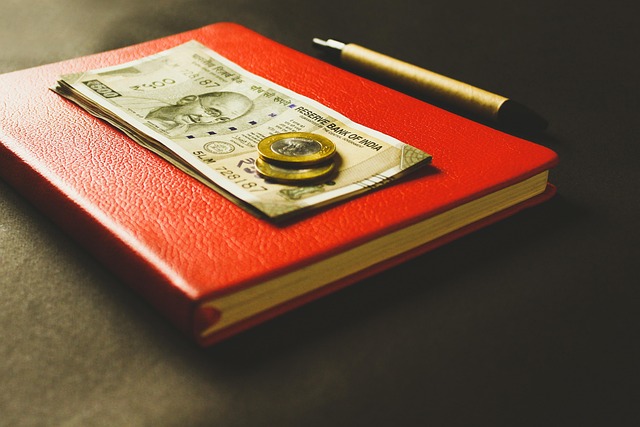

Car title loans Greenville TX have gained popularity as a quick source of emergency funding for many individuals. This type of loan is secured by the borrower’s vehicle, typically their car or truck. Lenders offer fast approval and access to significant financial assistance, making it an attractive option for those in need of immediate cash. The process involves using your vehicle’s title as collateral, allowing you to retain possession of your vehicle while gaining access to a lump sum.

Greenville TX residents often turn to car title loans when facing unexpected expenses or financial emergencies. With quick funding, these loans can provide much-needed relief during difficult times. However, it’s essential to approach this option strategically, ensuring you understand the terms and conditions to avoid potential pitfalls associated with high-interest rates and short repayment periods.

Steps to Budget After Securing a Loan

After securing a car title loan in Greenville, TX, the next step is to create and stick to a budget that will help manage your finances effectively. Start by evaluating your current income and expenses. Make a list of all your regular monthly costs, including rent/mortgage, utilities, groceries, insurance, and transportation. Then, subtract these essentials from your loan proceeds to determine how much you have available for discretionary spending.

This process will help you understand your financial situation post-loan. Allocate your money wisely, prioritizing essential expenses first. Consider using the loan funds for debt consolidation if you have multiple high-interest debts, like credit card balances or personal loans. This strategic approach can simplify your finances and potentially reduce long-term interest payments. Remember, responsible budgeting involves balancing short-term needs with long-term financial goals, especially when considering alternatives to car title loans such as semi-truck loans or exploring options without a strict credit check.

Effective Spending Strategies for Loan Repayment

After securing a car title loan in Greenville, TX, managing your finances effectively becomes crucial for successful repayment. One key strategy is to create a detailed budget that allocates specific funds for loan payments, essential expenses, and savings. Start by listing all income sources and categorizing monthly expenditures like housing, utilities, groceries, and transportation. This provides a clear overview of your financial situation.

Prioritize paying off the car title loan by incorporating it into your budget as a fixed expense. Consider setting up automatic payments to ensure timely repayments, avoiding late fees. Additionally, explore opportunities to cut back on non-essential spending or negotiate better terms for existing bills. By adopting these effective spending strategies, you can ensure compliance with your Houston title loans agreement and potentially free up funds for other financial goals, enhancing long-term financial stability.

Securing a car title loan in Greenville, TX, can provide much-needed financial assistance, but responsible budgeting is key to managing debt effectively. By understanding your loan amount and implementing practical spending strategies, you can successfully repay the loan while maintaining a healthy financial outlook. Embrace these steps and spending tactics to create a balanced budget after securing a car title loan in Greenville, TX, and take control of your financial future.